高通和三星怎么就从爱人变仇人了

今年高通这个全球最大的移动芯片制造商日子很不好过。还要从三星,高通第二大客户,在其旗舰机中用自家开发的芯片替代高通的应用处理器和调制解调器开始说起。

高通本来希望2015财年能实现营收增长到288亿美元,增幅9%。但在三星做出上述决定后,高通不得不多次调低营收预期,全年销售最后降低5%到253亿美元。

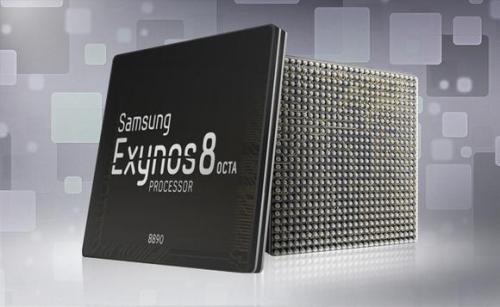

最近有谣传称三星可能会给高通第二次机会,在部分Galaxy S7中采用高通的下一代芯片骁龙820。这无疑可提升高通的营收预期,但三星最近也宣布推出其自有顶级芯片Exynos 8的十核产品8890,则预示了其他的可能。

It's been a rough year for Qualcomm (NASDAQ:QCOM), the biggest mobile chipmaker in the world. The year started with Samsung (NASDAQOTH:SSNLF), Qualcomm's second largest customer, replacing its flagship devices' application processors and modems with its own comparable chips.

Qualcomm had previously expected to generate between up to $28.8 billion in revenues in fiscal 2015, which would have represented 9% growth. After Samsung's decision, Qualcomm reduced its guidance repeatedly, and full-year sales eventually fell 5% annually to $25.3 billion.

Recent rumors suggest that Samsung might offer Qualcomm a second chance by installing its newest chipset, the Snapdragon 820, in some of its Galaxy S7 devices. While that could certainly boost Qualcomm's top line again, Samsung's recent introduction of its own top-tier chipset, the Exynos 8 Octa 8890, strongly suggests otherwise.

SOURCE: SAMSUNG.

What Samsung wants

Samsung presumably installed its own silicon in its top-tier handsets for three reasons. First, Qualcomm's Snapdragon 810 suffered from overheating issues. Second, using its own silicon can cut manufacturing costs and boost margins of its top-tier handsets. Lastly, it can potentially expand its chipmaking business and sell its Exynos processors and Shannon modems to other handset makers. That move would complement its sales of other components like memory chips and displays.

Samsung controls nearly 24% of the global smartphone market, according to IDC. However, competing against low-end rivals like Xiaomi and cramming expensive hardware into high-end devices to counter Apple's (NASDAQ:AAPL) iPhone have taken a toll on the mobile unit's bottom line. Last quarter, the unit accounted for just 32% of Samsung's operating profits -- a five-year low for the once-dominant division. Samsung doesn't disclose how much money it saves by using its own silicon, but after dropping Qualcomm, the mobile unit's profit margin notably rose from 7% to 9% between the third quarters of 2014 and 2015.

Because of the shrinking importance of its mobile unit, Samsung started beefing up its chipmaking operations to diversify its top line and generate additional revenue. Samsung also has one of the few foundries in the world that can produce application processors for next-gen smartphones. That foundry notably produced A9 chips for its smartphone nemesis, Apple. Last quarter, Samsung's semiconductor revenue rose 14% annually and accounted for 25% of its top line. Operating profit rose 8% and accounted for nearly half of its bottom line. Most of that growth was fueled by memory chip sales, but other OEMs, like Chinese smartphone maker Meizu, might install Exynos processors in their smartphones in the future.

MEIZU'S EXYNOS-POWERED MX4. SOURCE: MEIZU.

What Qualcomm fears

Both Qualcomm's Snapdragon 820 and Samsung's Exynos 8 Octa have custom 64-bit CPU cores that weren't designed by ARM Holdings (NASDAQ:ARMH). Qualcomm states that the 820 chipset boosts performance and power efficiency by 30% to 40% against previous chipsets. Samsung claims that the Exynos 8 Octa provides a 30% boost in performance over its predecessor, the Exynos 7420, and 10% better power efficiency.

- 高通半导体推出多国正版字库芯片(03-05)

- 高通半导体推出多国正版字库芯片,打开175国市场大门(03-08)

- 英特尔高通暗战CES:觊觎移动设备未来霸权(01-04)

- 2012 Q1 20大半导体厂商排名(05-16)

- 高通收购电源管理解决方案开发商Summit(06-19)

- 芯片供应链:高通MTK“抢食”传统路由(04-07)