恩智浦为什么能幸免于苹果“双刃剑”的伤害

因为近期不如预期的业绩表现,苹果公司的股价已经跌了超过10%,也拖累了一大批供应商。但也有例外,恩智浦半导体就守住了大盘,这要归功于恩智浦广泛的产品组合,可以从新兴的物联网应用中获利。

在苹果的供应商中,恩智浦提供近场通信芯片支持如Apple Pay这类非接触式支付功能,同时提供为sensor hub供电的电源芯片;Skyworks与安华高、Qorvo一起提供功放、射频芯片以实现无线连接;博通提供基带芯片;ARM通过其IP授权业务从包括苹果在内的客户处获益,分析数据称去年苹果贡献了其royalty营收的20%~25%。

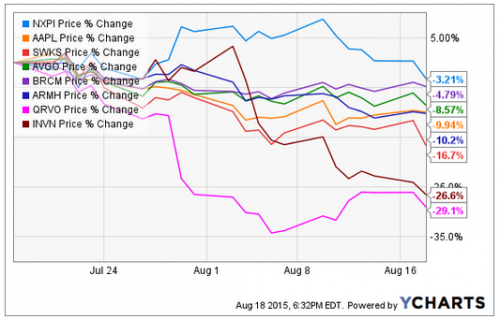

Shares of Apple (NASDAQ:AAPL) have now slid over 10% since the company's recent disappointing earnings release. Predictably, the company has taken down many of its suppliers along with it. However, NXP Semiconductors (NASDAQ:NXPI) has held its ground, actually gaining during this period despite some of its growth estimates tied to getting its chips into the iPhone. This demonstrates one of NXPI's greatest strengths -- a broad portfolio of products that will benefit from the general Internet of Things megatrend.

These companies all have one thing in common with each other -- they supply chips to Apple, largely in the iPhone. NXP supplies both the near-field communication chips used for contactless payments such as Apple Pay and the chip that powers the sensor hub. Skyworks Solutions (NASDAQ:SWKS), along with Avago Technologies (NASDAQ:AVGO) and Qorvo (NASDAQ:QRVO), provide multiple power amplifiers and radio frequency chips that enable wireless connectivity. Broadcom (NASDAQ:BRCM) supplies baseband chips, and ARM Holdings (NASDAQ:ARMH) is a fabless chipmaker that earns royalties on all chips that use their architecture, including those in Apple products; analysts estimate Apple provided 20% to 25% of their royalty revenue last year.

A two-sided coin

Many of the companies I've mentioned hit it big once Apple decided to use their chips in the iPhone. But like leverage, this cuts both ways, and now that some analysts are cutting back their iPhone sales estimate, some of these stocks are feeling the heat.

NXP has certainly benefited as well, but its chips in the iPhone aren't the only growth story it has going for it, and it certainly isn't the only product it has. In fact, NXP is getting to be a bit of a behemoth of a chip company -- once its merger with Freescale Semiconductor (NYSE:FSL) is complete, it will be the fourth largest semiconductor manufacturer.

NXP's business segments are divided into five categories, with each making up approximately 20% of revenue. The secure connected devices segment not only includes the mobile transaction products, but also microcontrollers used in a variety of electronics and Internet of Things applications. This segment is growing at double-digit rates along with their secure interfaces and power segment that is benefiting from all of the cellular data consumption and other radio-frequency chips.

With its lower growth rates, the automotive business segment may not be as sexy, but cars are increasingly being packed with more computer chips for use in entertainment, navigation, and in-vehicle networking. The other advantage to automotive is the long product cycle. Unlike consumer electronics, which can change chip components on a dime, once a product finally makes it into a car design, it tends to stay there a few years, giving the company a reliable revenue stream.

Finally, the secure identification solutions and standard products segments are the slowest growing, but NXP continues to be an industry leader in a number of these products, such as RFID tags and chip-based banking cards.

Beauty is in the ey

- 无线充电今起飞 预估出货1.2亿组(04-03)

- 拿着iPad见客户(09-29)

- Apple Watch带火NFC和无线充电技术?(02-02)

- 为羞辱Apple Watch而生:一款自发电的智能手表(07-10)

- 两岸LCD驱动IC迎来终极PK,都怪手机市场不给力?(10-04)

- 无线充电联盟惊现Apple,苹果要放弃自家Qi标准?(01-13)