这三大危机将成英特尔的梦魇?

高通在中国成立新的合资公司,目标是服务器市场;苹果的ARM处理器已经开始对英特尔的统治地位构成威胁;而英特尔的核心市场正经历动荡。

Summary

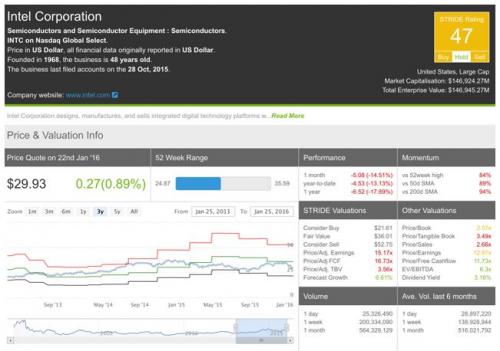

Qualcomm forming new joint venture in China targeting the server market. Apple ARM processors starting to become real threat to Intel dominance. All this is happening while Intel core market is shrinking.Intel Corporation (NASDAQ:INTC) has had a rough ride over the past year with shrinking revenues, slowing data centre growth and weak guidance.

The bad news looks set to continue with two new threats looming on the horizon. One is a very real and present threat from Qualcomm (NASDAQ:QCOM) which is just entering the server chipset market. The other is more of a potential threat, but is sourced from the same place as some of Intel's current grief - Apple Inc (NASDAQ:AAPL).

Qualcomm threat

Last week, Qualcomm unveiled a new joint venture with the People's Government of Guizhou Province. The agreement sees both parties ponying up $280 million a piece to a fund focused on building "world class server chipsets in China."

Qualcomm also is bringing existing design and processes to the party to help jump start the operations. This is a major move as it draws on the significant experience of ARM Holdings (NASDAQ:ARMH).

Qualcomm has seen competition enter their core markets of mobile processors and model technologies, so this move seems to have come from increasing pressure on their own revenue streams.

The move is well timed too as Intel has recently been blocked from shipping server chips into China by the US government on the grounds that it opposes current national security interests.

Given that server chipsets and the data center have been the only bright spot on Intel's radar for the past two years, this move could really hit the chip manufacture where it hurts.

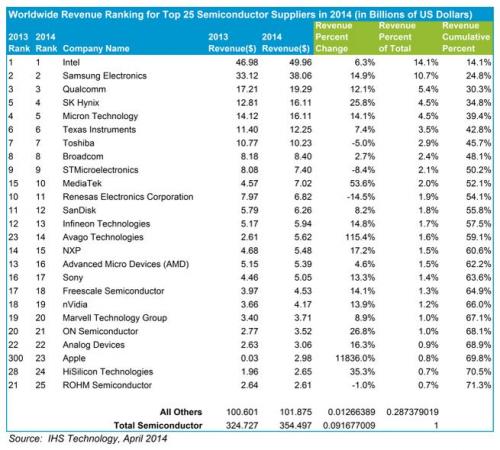

Intel has been feeling the heat from competitors increase over the past 3-5 years. Qualcomm has been a key part of that trend and is looking to turn it up a notch.

Apple threat

While all that has been happening, the rumor mill keeps grinding out ARM-based Macs on the back of their impressive performance gains. Anandtech recently did an iPad Pro review that might be sparking a few meeting requests internally at Intel.

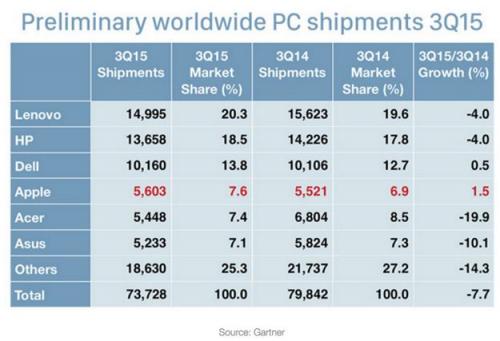

With Apple now making up 7.6 percent of the PC market - which is 59% of Intel revenue, a move away from Intel would effectively shrink Intel revenue by about 4.6% overnight. One of the few PC vendors that is actually growing, Intel wouldn't want to lose Apple as a customer now.

Let's be honest. That isn't going to happen anytime soon. While the new A9X processor is a very impressive step up from the A8X, it certainly isn't on a par with Intel's mobile processing platform yet.

Shrinking market

With Intel facing a shrinking PC market and a slowing server chipset market, they really didn't need further headwinds - yet that is exactly what they're facing.

With digitization strategies in full force, the mobile revolution and the IoT explosion, one would think that a powerhouse like Intel wouldn't be struggling to find growth, but that's exactly what is happening. Their razor sharp focus on standard computing chipsets was seen as a strength in days gone by... now it might be the thorn in their side.

Outlook

Ultimately, they are forecasting medium single digit growth and we are in complete agreement.

Our engine is forecasting 6.63% growth over the next year and, as such, we see Intel having a fair value of around $36. That's a 24% premium to the

- 英特尔总裁唱衰晶圆代工业(02-23)

- ARM手机芯片市场份额已超90% 英特尔倍感压力(03-17)

- 中国正探寻如何快速进驻HPC芯片领域(03-23)

- 业界不惧英特尔3D晶体管来势汹涌(05-09)

- 第一季度全球20大芯片厂商排行榜出炉 (05-20)

- Q1全球20大芯片厂商排行榜出炉 英特尔夺回优势(05-20)