谁在唱衰高通?3个理由驳倒你

高通这家全球最大的移动芯片供应商今年的日子并不好过,其最大的客户之一三星在其旗舰机Galaxy S6中采用了自家的芯片产品而放弃了高通骁龙处理器以及无线调制解调器,还要面对低端对手联发科和锐迪科的竞争,后两者在一些新兴市场有很多低端产品供货。这些挑战让高通在上个季度降低了2015财年营收的最高预期,调整后的数据为15亿美元,如此一来高通今年以来股价跌去20%也就不足为奇了。但在下跌之后,该股票看起来仍值得作为长期投资对象,原因有三,包括专利、乐观的分红和品牌价值,以及成长的机会

Qualcomm (NASDAQ:QCOM), the largest mobile chip maker in the world, has had a tough year. Samsung, one of its top customers, dropped its Snapdragon chips and wireless modems from its flagship Galaxy S6 handsets in favor of in-house components. It also faces rising competition from cheaper rivals like MediaTek and RockChip, which power many low-end devices in emerging markets.

Those challenges led Qualcomm to reduce the high end of its fiscal 2015 revenue forecast by $1.5 billion last quarter Therefore, it isn't surprising that Qualcomm stock has slid over 20% since the beginning of the year. But after that decline, the stock looks like a solid long-term investment for three reasons.

1. Patents, not chips

Qualcomm's QTL (Qualcomm Technology Licensing) business, which licenses CDMA technologies to handset makers worldwide, entitles the company to a 3% to 5% cut of the wholesale price of every smartphone shipped worldwide.

Last quarter, the unit accounted for 86% of Qualcomm's pre-tax earnings despite only generating a third of its revenues. The unit has also been growing at a healthier rate than its QCT (Qualcomm CDMA Technologies) chipmaking business. The QTL unit's revenue and pre-tax earnings both rose 7% annually last quarter, compared to the QCT unit's 22% decline in revenue and 74% plunge in pre-tax earnings.

That divergence has fueled constant speculation that the two units could be split into stand-alone companies. But as I discussed in a previous article, Qualcomm is using the QTL business to support the QCT one, so separating them might help the former but crush the latter. Looking ahead, Qualcomm's business model remains unbalanced, but bottom line growth at the QTL unit could help offset losses at its QCT unit.

2. Dividends and valuation

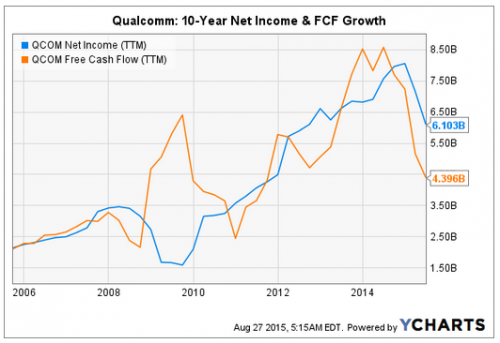

Qualcomm's bottom line took a big hit last year due to a $975 million antitrust fine in China. But excluding that speed bump, its net income and free cash flow growth have remained fairly solid over the past 10 years.

SOURCE: YCHARTS

Over the past 12 months, Qualcomm paid out 65% of its free cash flow as dividends, compared to Intel's (NASDAQ:INTC) FCF payout ratio of 41%. This means that both chipmakers have room to keep raising their dividends. Qualcomm has raised its dividend annually for 12 consecutive years, with an average increase of 22% per year over the past four years. Intel's dividend meanwhile was frozen at $0.22 per share from 2012 to the end of 2014, after which it was increased by just 4.5%. Qualcomm currently pays a forward annual dividend yield of 3.5%, while Intel yields 3.7%. Both yields are significantly higher than the average S&P 500 yield of 2.15%.

Qualcomm is also a fundamentally cheap stock. The stock trades at 15.5 times trailing earnings, compared to an average P/E of 19 for the communication equipment industry.

3. Opportunities for growth

Qualcomm plans to diversify away from the premium smartphone market by expanding into the Internet of Things (IoT) market. IDC expects that market, which consists of everyday objects connected to each other, to grow from $1.9 trillion in 2013 to $7.1 trillion by 2020.

专利 Qualcomm 高通 骁龙处理器 Snapdragon 相关文章:

- 小小触摸屏折射企业专利战略之重(07-05)

- 在专利收购战中进化的硅谷生态链:专利如货币(08-19)

- 分析2011年LED显示屏行业发展趋势(09-16)

- 分析称专利纠纷或损害三星平板和芯片业务 (09-28)

- 数据显示三星在通信技术专利上压倒苹果(10-09)

- 半导体设计公司Mosaid诉苹果专利侵权(03-08)