英特尔的财报是出错了吧

近日一篇媒体报道提到了对英特尔公司库存和销售的分析,进而得出结论称其营收受到工艺制造进程迟缓的影响增加了库存成本。不得不说这篇报道努力想要说明一些问题,但我认为他的分析犯了一个低级错误。

在对比了历史上每一季度的库存和营收的关系之后,作者断言库存过高以致于无法比较和营收之间的历史相关性。这反而得出结论库存包含了已被资本化的制造成本,而不是用在正确的地方。

正确的分析应该是比较每一季度与接下来的下一个季度的营收,毕竟建立库存是为了应对预期的销售增长。

A recent article by SA Contributor Chris Ridder contains an analysis of the relationship of Intel Corporation (NASDAQ:INTC)’s inventory and sales, and concludes that earnings have been inflated by deferring excessive manufacturing overhead costs into inventory. While his diligence in addressing accounting issues relevant to performance is to be commended, I believe that he has made a fundamental error in his analysis.

Briefly, after comparing the historical relationships between each quarter’s inventory and revenues, he asserts that inventory is too high compared to its historical relationship to revenue. This in turn leads to the conclusion that inventory contains manufacturing overhead costs that have been capitalized, rather than expensed in the proper quarter.

The proper analysis compares each quarter’s inventory to the subsequent quarter’s revenue. After all, inventory is created in response to expected sales going forward.

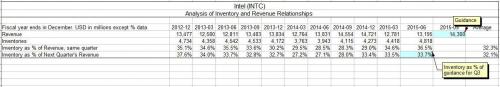

Here’s a spreadsheet:

Please note that 3Q 2015 revenue guidance is included in the analysis. When 2Q inventory is compared to expected sales for the coming quarter, an entirely normal relationship appears.

2014 was an unexpectedly good year for Intel, driven in large part by PC sales that were higher than anyone in the industry anticipated. Under the conditions, inventory ran about 28% of the subsequent quarter’s revenues for three quarters, before reverting to something over 33%, consistent with prior experience.

At 33.7% of 3Q 2015 guidance, 2Q 2015 inventory is right in line.

Complexity around Inventory Accounting

The article drew a thoughtful comment stream. Among the issues raised was Intel’s use of FIFO (first-in-first-out) accounting in a decreasing cost environment. Intel’s inventory consists of raw materials, work in process and finished product. Inventory is marked to the lower of cost or market.

Due to the proliferation of product designs and the rapid obsolescence characteristic of the business, mark to market will ultimately govern inventory valuation. If Intel makes more of a specific product than the market will absorb prior to obsolescence, it will be marked down and disposed of.

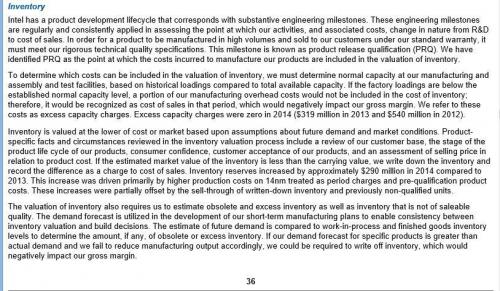

The following discussion from the 2014 10-K is relevant:

The key elements here are manufacturing overhead, pre-qualification product costs and obsolescence. Due to the complexity of these factors, efforts to determine the accuracy of inventory by applying simple ratios and algebraic extrapolations are of limited usefulness.

More Important Questions

Meanwhile, CEO Brian Krzanich has stretched out the 2 year time frame for migration between nodes according to Moore’s law to 2.5 years. The company didn’t do 14 nanometers according to schedule, and now the time frame for 10 has been pushed back.

President Renee James will be leaving the company in search of greener pastures, never a good sign.

And IBM has announced success in creating working chips at 7 nanometers, using new materials and processes.

- 英特尔总裁唱衰晶圆代工业(02-23)

- ARM手机芯片市场份额已超90% 英特尔倍感压力(03-17)

- 中国正探寻如何快速进驻HPC芯片领域(03-23)

- 业界不惧英特尔3D晶体管来势汹涌(05-09)

- 第一季度全球20大芯片厂商排行榜出炉 (05-20)

- Q1全球20大芯片厂商排行榜出炉 英特尔夺回优势(05-20)