凌力尔特2016财年第一季度财报公布

凌力尔特公司近日公布了其2016财年第一季度财报,每股盈利46美分,基本符合分析机构此前的预期。该公司股价当日仅增长了3.96%,因为一些分析师指出凌力尔特公司给出的二季度营收预期要比分析师们的预期值低了4%。

Linear Technology Corp. (LLTC - Analyst Report) reported first-quarter fiscal 2016 earnings of 46 cents, which were in line with the Zacks Consensus Estimate.

Linear’s share price gained 3.96% in the after-trading hours as a few analysts consider the company’s second-quarter guidance to be better than their expectations of a 4% decline。

Revenues

Linear reported revenues of $341.9 million, down 7.9% year over year and 9.9% sequentially. Also, revenues were at the lower end of the guidance range but missed the Zacks Consensus Estimate of $343.0 million due to lower-than-expected bookings.

Revenues declined in all the major geographies. In terms of end markets, the Industrial market suffered the maximum decline, followed by Communications and Transportation. However, the Computer market improved slightly.

Margins

Gross margin was 75.1%, down 98 basis points (bps) sequentially and 93 bps year over year.

Operating expenses of $106.8 million were down 4.7% sequentially and 0.8% year over year. As a percentage of sales, both R&D and selling, general and administrative (SG&A) expenses increased marginally. As a result, operating margin of 43.8% was down 268 bps sequentially and 314 bps year over year.

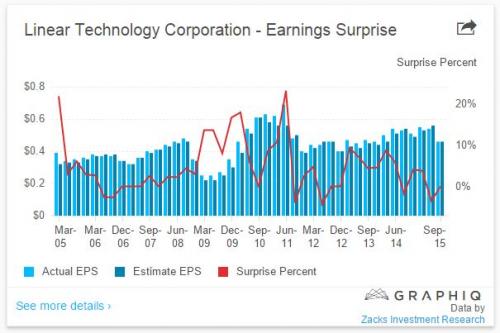

Linear Technology Corporation - Earnings Surprise | FindTheBest

GAAP net income was $112.0 million or 46 cents per share compared with $132.7 million or 54 cents in the previous quarter and $129.5 million or 53 cents a year ago. As there were no one-time items, pro-forma earnings were also 46 cents, down from 53 cents last year.

Balance Sheet

Linear exited the quarter with cash, cash equivalents and marketable securities of approximately $1.24 billion as against $1.20 billion in the prior quarter. Account receivables were $153.7 million, down from $179.3 million in the fourth quarter.

Linear generated $175.7 million from cash for operations, spending $10.2 million on capital expenditures. Free cash flow was $165.5 million in the last quarter. The company spent $56.6 million on share purchases and $129.9 million on dividends.

Guidance

Management provided weak guidance for the second quarter of fiscal 2016. The company expects revenues to be flat to up 3% sequentially due to weakness in the industrial market and a cautious macroeconomic environment. The Zacks Consensus Estimate is pegged at $341.0 million.

Conclusion

Linear Technology reported a weak quarter with earnings coming in line with but revenues missing our expectations. The company’s business is well-diversified among core markets, such as industrial, automotive and communications infrastructure.

The soft revenue guidance reflects weakness in its end markets and volatility in the semiconductor space.

Nevertheless, Linear has an impressive record of returning cash to shareholders through dividends and share buybacks, which should increase investors’ confidence, in our view.

Linear carries a Zacks Rank #4 (Sell). Some stocks that are worth a look in the same space are Inphi Corp. (IPHI - Snapshot Report), MaxLinear, Inc. (MXL - Snapshot Report) and Ixia (XXIA - Snapshot Report). While Inphi sports a Zacks Rank #1 (Strong Buy), MaxLinear and Ixia carry a Zacks Rank #2 (Buy).

- 凌力尔特LT3959升压转换器(08-10)

- 凌力尔特推出效率为96% 的降压-升压型开关稳压控制器(09-10)

- 凌力尔特推出电流模式、固定频率升压型DC/DC 转换器(09-11)

- 凌力尔特降压模式转换器用作16 通道恒定电流LED驱动器(09-15)

- 凌力尔特推出48V恒定电流LED驱动器(09-16)

- 凌力尔特公司推出 3.5A、36V 降压型开关稳压器(09-12)